Michael D. Sullivan, a Former IRS Agent, leads a nationwide team of tax professionals at MD Sullivan LLC, based in Florida. Our team includes experienced Tax Attorneys, Lawyers, CPAs, Enrolled Agents, and ex-IRS Agents, offering over 250 years of combined IRS resolution experience. We specialize in resolving IRS back tax penalty cases efficiently and effectively. Michael D. Sullivan provides immediate representation to stop IRS intrusions into your business and personal life, ensuring peace of mind. For IRS tax relief, expert tax solutions, and top-tier tax services in Florida, trust MD Sullivan LLC.

Should you gained a detect or letter declaring we denied your request for penalty relief, see Penalty Attraction Eligibility for following techniques.

WASHINGTON — As element of continuing endeavours to assist taxpayers, The interior Revenue Provider currently declared designs to situation automated payments later this thirty day period to eligible those who did not claim the Restoration Rebate Credit history on their own 2021 tax returns.

The prospect will need to remove the lid/cap for visual inspection through the Check Center employees. Must the container not meet up with the necessities outlined, the candidate might be needed to place it of their locker and will not be permitted to just take it in to the test place.

Before submitting a tax return, you wish an IRS Director (not Chief Counsel) to determine the tax cure of the distinct scenario and provide you with a published perseverance to attach to your submitted return. The letter signifies an arrangement on treatment method on the transaction.

In the event you obtained a observe or letter, confirm the knowledge is accurate. If the data isn't appropriate, Keep to the Directions with your detect or letter. If you're able to take care of The problem, a penalty might not utilize.

We assistance taxpayers whose difficulties are resulting in economic problem. This includes organizations and people.

We’re in search of accounting experts IRS revenue agent in any respect stages to hitch our workforce as Revenue Agents. Revenue Agents use their accounting skills to plan and conduct examinations of individuals and firms to find out Federal tax legal responsibility.

Once you post your software, the IRS will evaluate your offer and assets to make a decision In the event your OIC is acknowledged or rejected.

“You can find achievable exceptions, like possessing a serious disease, Or even caring for any loved 1 who has a serious illness and may't operate. Even so the IRS needs you to dig deep, promote your assets and pay everything you can, not merely fork out with regardless of what liquid dollars you might have available,” Koullick says.

When you are facing financial hardship, you may be eligible to ask for a short-term collection delay until finally your finances boost.

Get the free credit scoreYour credit score reportUnderstanding your credit score scoreUsing your creditImproving your creditProtecting your credit rating

Make sure you Take note this office is set up exclusively for responding to inquiries through the press (news media). Inquiries and account inquiries from most of the people and organizations can't be managed by this Business.

Connecting decision makers to your dynamic network of data, men and women and ideas, Bloomberg promptly and precisely provides organization and financial facts, news and Perception around the globe.

Requests has to be created for the LB&I Group Manager for taxpayers presently below examination. In the case of a taxpayer with no tax returns under assessment, a ask for for your PFA is often despatched by any on the approaches explained in Revenue Treatment 2016-30.

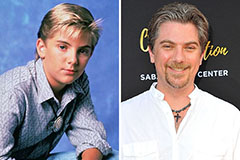

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Rick Moranis Then & Now!

Rick Moranis Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now!